Sustainable Finance and Socially Responsible Investing Are Changing Finance

A growing number of investors are encouraging financial institutions to act responsibly.

In recent years, there has been a growing trend towards sustainable finance and socially responsible investing (SRI) in the financial industry.

Sustainable finance refers to financial activities that take into account environmental, social, and governance (ESG) factors, while SRI involves investing in companies that meet certain ethical and social standards.

Impact investing is also a popular approach that aims to contribute to the achievement of measured positive social and environmental impacts. It has emerged as a significant opportunity to mobilize capital into investments that target measurable positive social, economic, or environmental impact alongside your financial returns.

This article will explore the importance of sustainable finance and SRI, some successful initiatives, how they are changing the investment landscape as well as discuss the future of finance.

1. The Importance of Sustainable Finance & Socially Responsible Investing

Sustainable finance is the integration of ESG factors into financial decision-making. This approach recognizes that environmental, social, and governance issues can impact financial performance and seeks to create positive outcomes for both investors and society. For instance, sustainable finance could involve investing in renewable energy projects or supporting companies with a strong record on social responsibility. By taking these factors into account, investors can reduce risks and improve long-term returns while contributing to a more sustainable future.

Socially responsible investing (SRI) involves investing in companies that meet certain ethical and social standards. This can include companies with strong records on environmental stewardship, labor practices, human rights, or diversity and inclusion. By investing in these companies, investors can align their financial goals with their values and support positive social and environmental outcomes.

2. Initiatives That Are Promoting Sustainable Finance

One major example of sustainable finance is green bonds, which are issued to finance projects with environmental benefits such as renewable energy, clean transportation, or energy efficiency. Another example is impact investing, which involves investing in companies or projects with the intention of generating a measurable social or environmental impact alongside a financial return. Many financial institutions are also integrating ESG factors into their investment strategies or offering sustainable investment products.

Another example of SRI is investing in companies that prioritize employee well-being and have strong labor practices, such as providing fair wages and benefits or promoting work-life balance. Another example is investing in companies that prioritize sustainability, such as those with strong records on reducing carbon emissions or promoting resource efficiency. Many investment firms also offer SRI-focused mutual funds or exchange-traded funds.

3. How Sustainable Finance and Socially Responsible Investing Are changing the Investment Landscape

Sustainable finance and socially responsible investing are changing the investment landscape by introducing new considerations and standards for financial decision-making. By taking into account ESG factors, investors can evaluate risks and opportunities more comprehensively, leading to potentially better long-term returns. This shift towards sustainable finance and SRI is also creating new investment opportunities, such as green bonds and impact investing, which can support positive social and environmental outcomes while generating financial returns.

As more investors prioritize sustainability and social responsibility, companies are also being incentivized to improve their ESG practices to attract investment. Sustainable finance and SRI are reshaping the investment landscape to prioritize positive outcomes for both investors and society.

4. What's The Future of Sustainable Finance?

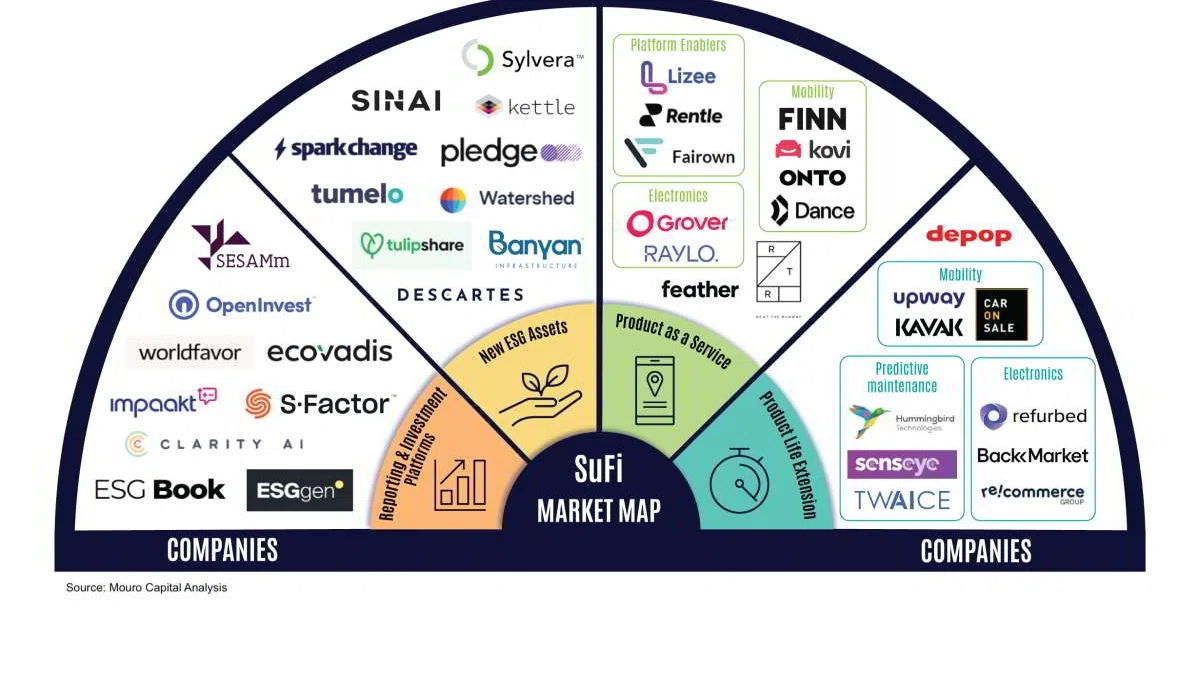

Source: Mouro Capital Analytics

The emergence of sustainable finance and socially responsible investing reflects a growing recognition that financial decisions can have broader impacts on society and the environment. By considering ESG factors in investment decisions, investors can contribute to positive outcomes while also generating long-term returns. As sustainable finance and SRI continue to grow, they have the potential to reshape the investment landscape and promote a more sustainable and equitable future.

The future of sustainable finance is promising and it is expected to continue to grow and evolve in the coming years. Here are some key trends that are likely to shape the future of sustainable finance:

-

Mainstream adoption: Sustainable finance is no longer a niche area and is becoming mainstream. More and more investors are recognizing the importance of ESG factors in investment decision-making and are seeking out sustainable investment opportunities. This trend is likely to continue as investors become more aware of the impact of their investments on society and the environment.

-

Technology and innovation: Technology and innovation are likely to play a key role in the future of sustainable finance. This could include the use of blockchain technology to enhance transparency and traceability in sustainable finance transactions, the development of new sustainable financial products, and the use of artificial intelligence and machine learning to better assess ESG risks and opportunities.

-

Regulation: Regulatory frameworks are likely to evolve to encourage greater adoption of sustainable finance. This could include the development of standards and guidelines for sustainable investments, as well as tax incentives and other policy measures to encourage sustainable investments.

-

Impact measurement and reporting: There will be a growing emphasis on impact measurement and reporting in sustainable finance. Investors will increasingly demand more transparent and standardized reporting on the social and environmental impact of their investments, and companies will be expected to disclose more information on their ESG practices.

-

Integration of sustainability into business strategy: Sustainability will be increasingly integrated into business strategy, as companies recognize the importance of sustainability in attracting investors and consumers. This could include the development of sustainability-linked financial products, such as sustainability-linked loans and bonds, that incentivize companies to meet sustainability targets.

The future of sustainable finance is likely to be characterized by greater mainstream adoption, increased use of technology and innovation, evolving regulation, greater emphasis on impact measurement and reporting, and the integration of sustainability into business strategy.

Trending

-

1 Building a Strong Financial Foundation: Saving, Investing, and Retirement Planning

Daniel Hall -

2 Franchise Investment Pitfalls to Avoid: A Beginner's Checklist

Daniel Hall -

3 Why Selling to an iBuyer Could Be the Best Move for Your Home

Daniel Hall -

4 Financial Tips for Businesses: Reducing Expenses Without Sacrificing Quality

Daniel Hall -

5 9 Tips to Help You Secure a Graduate Job in Finance

Daniel Hall

Comments