The Path to Smarter, Greener Banking

Solving climate change will require banks to migrate almost entirely to the cloud.

For the last few years, we’ve heard a lot of noise about the massive energy sink that Bitcoin mining is. In fact, it is estimated that in 2021 Bitcoin miners consumed a total of around 113 terawatts (TWh) hours of energy — that sounds like a lot right? Until you put the banking industry up next to it at least. The global banking industry and the gold sector each individually consume annually more than twice the energy than that of bitcoin mining. A recent report from Galaxy Digital found that banking and gold consume around 263.72 TWh per year and 240.61 TWh per year, respectively.

When we look at the push around digitization along with the call for green, sustainable banking, it appears Bitcoin is the least of our problems. If you’re a bank looking at ESG (Environmental, Social, and Governance) initiatives, energy consumption is your next big arena.

Intelligent Finance

This is at the heart of the recent strategy shift from Huawei’s Enterprise Business Group Financial Services Industry group which we saw in Singapore this week at the Intelligent Finance Summit. We heard from Huawei leadership Ryan Ding (President of Enterprise BG) and Jason Cao (CEO Global Digital Finance), as well as industry notables such as author Dave Birch, DBS CIO Jimmy Ng, and Vincent Loy from the MAS; all debating the challenges and opportunities in the intelligent, digitized remake of the financial services industry that we’ve seen which rapidly accelerate during the pandemic.

A theme that emerged early is the work Huawei has done on creating a specialist cloud architecture for financial services, and the key to this development is an unyielding focus on energy-efficient operation. As both Ryan and Jason contended, the digitilization of financial services creates a big energy consumption problem for the world. Banks are already big users of energy, as seen by the statistics above, but digital transformation efforts are pushing that energy consumption to dangerous new heights when seen in the context of rising global temperature and eco-distress.

China as the Proving Ground for the FSI Cloud

Huawei is now the largest provider of financial services cloud capability in China and is the fastest growing of the top 5 cloud providers globally. But to illustrate the size of the problem in China, Huawei shared some mind-blowing statistics. Energy consumption is directly correlated with compute power and data consumption, so a market the size of China is always going to be a critical proving ground for more energy-efficient operations.

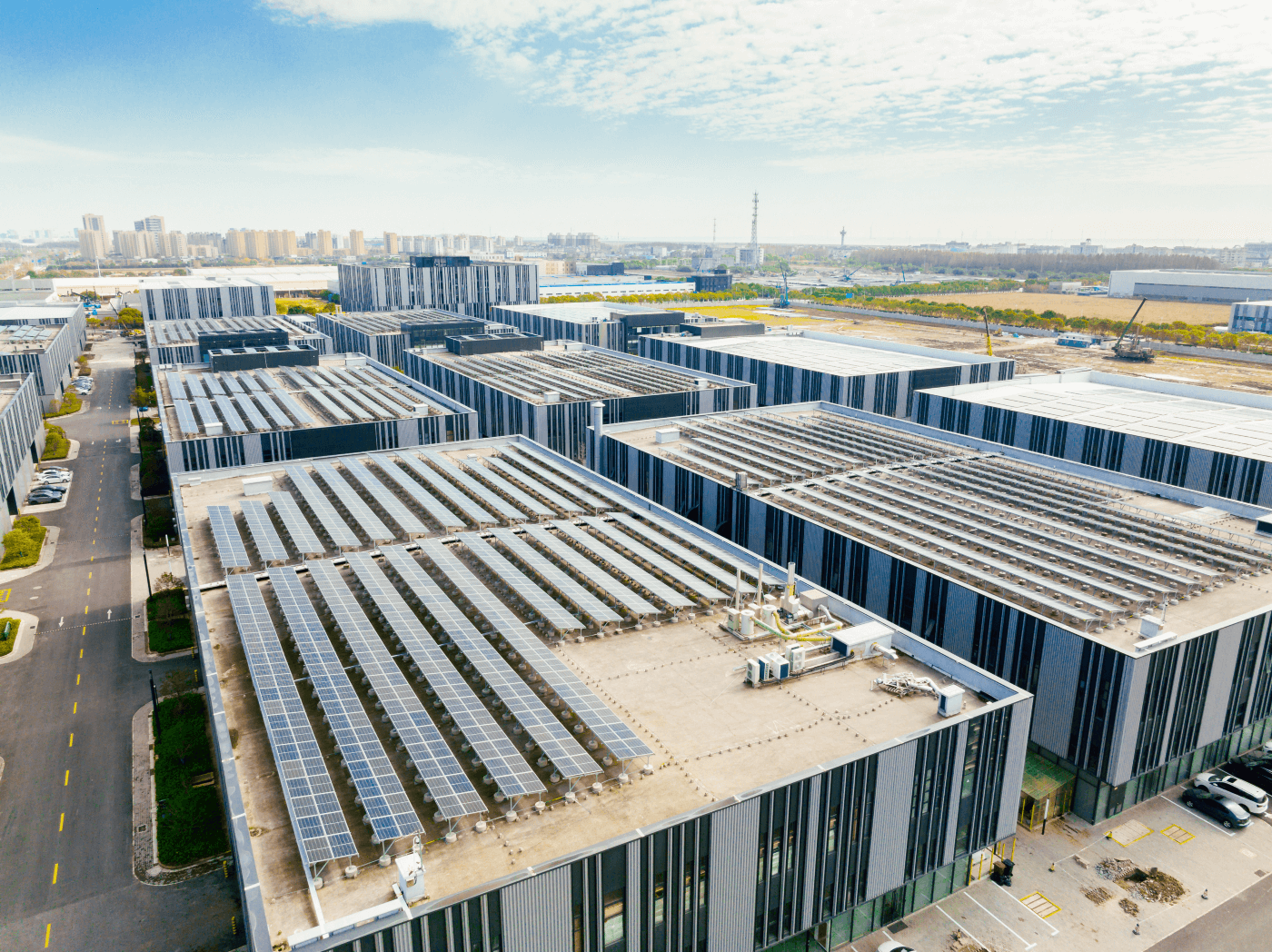

Huawei has invested heavily in Solar PV installations that support their cloud operations (Credit: Huawei)

China Merchants Bank, for example, has a 10 Petabyte (Pb) data volume annually. ICBC, the largest bank in China, has already offloaded 90% of its mainframe traffic to the cloud, meaning its cloud stack is utilized 12 Billion times per day. China’s postal savings bank has a 600m active user base. On top of this, as we see AI implementation, data utilization is intensifying. The metaverse will also generate more demand for cloud-based services, with the Bank of “Things” and metaverse platforms combining to create the equivalent of 75 Billion digital humans by 2030 alone (Source: Huawei EBG)

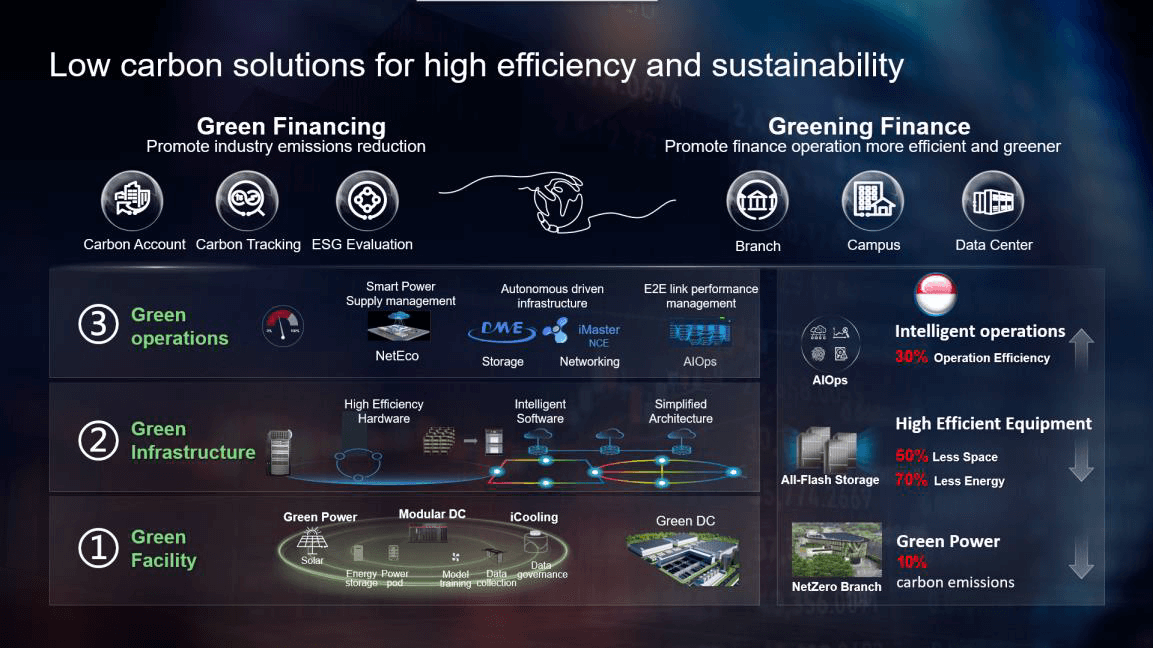

Sustainable, Green Infrastructure must be Autonomous and Cloud Based (Source: Huawei EBG)

As Cao detailed, in recent years as demand for their cloud operations has exploded, Huawei has invested heavily in autonomy, power management, and generation. Focusing on renewable power sources such as solar, more effective data center energy management, and energy recycling.

Fortunately, we have digital energy or digital solutions for energy consumption, and we have [solar] PV energies as well as smart energy. The second aspect we’re focusing on is power consumption. For banks to use a lot of equipment, we can actually apply technology to improve the efficiency of heat spreading so that the power used for the cooling system will be reduced. And specifically we have designed some recycle system for heat to be dispersed efficiently and smartly.

Jason Cao, CEO Global Digital Finance Team, Huawei at the HIFS media roundtable

A Smart World Needs Sustainable Compute Power

Between 1956 and 2015 the world saw a 1 Trillion-fold increase in computing power. To illustrate, the 1985 Cray-2 supercomputer was surpassed by the iPhone 4 release in 2010. Our modern smartphones have millions of times the processing power, storage capacity and memory of iconic computers like the Apollo Guidance Computer that took the Apollo astronauts to the moon. But as we move into an era of autonomous supply chains, smart cities and artificial intelligence, the computing demands will just intensify by orders of magnitudes. Becoming smart 21st century economies will require a ton of energy, but as we fight climate change simultaneously, we’ll need to revolutionize energy management of our combined computing infrastructure.

All of this autonomous capability will have massive benefits to society in terms of operational efficiency and massive cost reductions, lowering the cost of basic services like healthcare for example. As an illustration of this, DBS Bank in Singapore shared that the cost-to-income ratio of their digital segment was less than half that of their traditional operations historically. In my recent book, we estimate we could cut the total cost of US healthcare by 70% using a range of technologies by the mid-2030s, mainly around AI.

The Metaverse

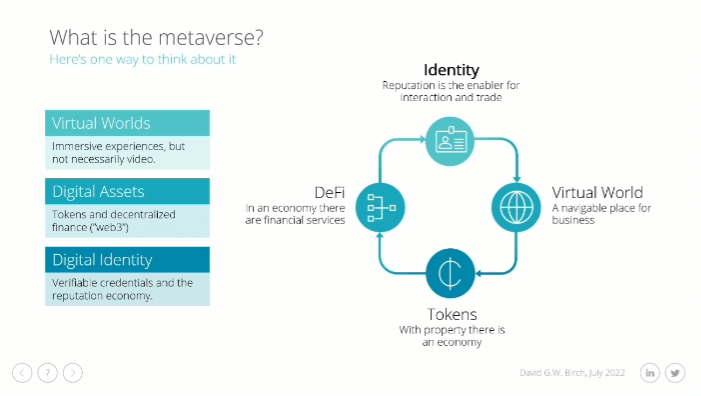

To round out our discussion though, I wanted to change tack a little and jump into the Web 3, crypto + metaverse world. The task of breaking down this at the Summit future space fell to my good friend Dave Birch. Dave gave a 15-minute masterclass on why the Metaverse matters and how crypto, NFTs, CBDCs, and tokens fit into our near-term future.

The Metaverse According to Birch (Source: David G. W. Birch)

Dave broke down the Metaverse hype into three core components — the virtual worlds we will interact with (Augmented worlds overlaid on our real-world and immersive virtual worlds), the tokenized digital assets we’ll own or utilize, and our credentials and identity we’ll use in those digital worlds.

Ready Player One shows the potential of hybrid digital wallets in the Metaverse (Credit: Warner Bros)

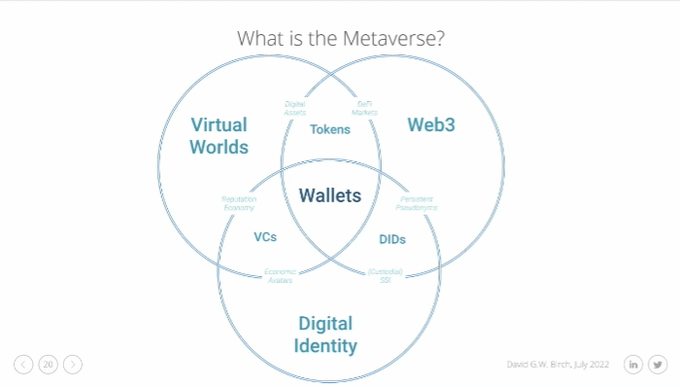

When we hear talk about the Metaverse and Web 3, the focus is often on the nature of the digital worlds themselves and what we’ll do there, the virtual property we’ll own, and the role our avatars will play. But as Dave Birch explained, in the metaverse we’ll need to be uniquely identified and we’ll need to transact, just like in e-commerce and m-commerce applications today. But it will need to be much more seamless and interactive than the way we pay for things today, hence leading to the inevitable capabilities of our wallets. Our wallets are moving into the cloud because they have to — you can’t use cash or swipe a card in the metaverse, nor in the 21st century smart economies emerging tomorrow.

Our presence in the Metaverse will require Digital Wallets and Identity (Source: DGWBirch)

The future of the world is digital, and if we’re going to make it sustainable and green, we need to make a massive investment in energy-efficient cloud operations. Likely this means that most of our day-to-day banking will move out of on-premise core systems to the cloud. The size of investment in hardware and intelligent cloud architecture to make this happen is massive. Everything relies on this though. Not only our presence in the metaverse but every real-time, contextual, embedded finance and banking scenario of the future.

Core is out, Cloud is in. Cash is out, Wallets are in. It’s the only way we’ll build a sustainable, 21st-century banking system.

Disclaimer: This article is part of a series on the evolution of financial services infrastructure globally, in part sponsored by Huawei.

Trending

-

1 Building a Strong Financial Foundation: Saving, Investing, and Retirement Planning

Daniel Hall -

2 Franchise Investment Pitfalls to Avoid: A Beginner's Checklist

Daniel Hall -

3 Why Selling to an iBuyer Could Be the Best Move for Your Home

Daniel Hall -

4 Financial Tips for Businesses: Reducing Expenses Without Sacrificing Quality

Daniel Hall -

5 9 Tips to Help You Secure a Graduate Job in Finance

Daniel Hall

Comments