The Competitive Landscape of Low-Cost Carriers in Belgium: TUI Fly Belgium’s Position

The aviation sector in Belgium has witnessed significant transformations over the past few decades, particularly with the rise of low-cost carriers (LCCs).

These budget airlines have revolutionised travel by offering affordable fares, making air-budget travel accessible to a border demographic.

This article delves into the competitive landscape of LCCs in Belgium, spotlighting TUI Fly Belgium’s position within its dynamic market.

Overview of Low-Cost Carriers (LCCs)

LCCs have disrupted traditional airline models by prioritising cost-efficiency, operational efficiency, simplicity, and competitive pricing. Their emergence has democratised air travel, increasing passenger traffic and market competition. LCCs typically operate with a single aircraft type, minimising training and maintenance costs and employing direct sales channels to avoid agency fees.

Graph A shows the increasing market share of LCCs in the European air transport market from 1998 to 2018, according to the Eurocontrol European Aviation Overview.

Importance of Belgian Market

Belgium’s strategic location at the heart of Europe makes it a critical market for LCCs. The country’s connectivity and high propensity for travel and residents create fertile ground for budget airlines. Brussels, the capital, is a significant hub, facilitating business and leisure travel across Europe and beyond.

Historical Context

Several historical milestones marked the rise of TUI Fly and LCCs in the European aviation market.

Evolution of LCCs in Belgium

The evolution of low-cost carriers (LCCs) in Belgium reflects broader European aviation trends, beginning with the 1993 EU deregulation, which allowed airlines like Ryanair and easyJet to expand.

Ryanair entered Belgium in 2001, operating from Charleroi Airport, while TUI Fly Belgium, initially Jetairfly, was founded in 2003. The 2004 EU enlargement boosted LCC demand and connectivity. During the 2008 financial crisis, LCCs thrived due to increased demand for affordable travel.

In 2014, Jetairfly rebranded as TUI Fly Belgium and expanded its route network. TUI Fly Belgium introduced long-haul low-cost flights in 2017, standing out in the market. Despite challenges from the COVID-19 pandemic in 2020, its focus on leisure travel facilitated a quicker recovery.

Today, thanks to strategic expansions and a strong route network, TUI Fly Belgium is a significant player in the Belgian LCC market.

Competitive Landscape Analysis

Let’s take a look at the current competition at play in Belgium's airline industry:

Major Players in the Belgian LCC Market

With their market niches and strategies, Ryanair, Easyjet, and Wizz Air compete fiercely in the Belgian LCC market. These airlines have established robust networks and competitive pricing strategies, challenging TUI Fly Belgium’s market position.

Market Entry and Exits

Regulatory policies, like environmental and consumer protection laws, affect cost and flexibility. Airport infrastructure, fuel prices, and exchange rates also impact competition.

TUI fly Belgium’s Position

Market Position and Share

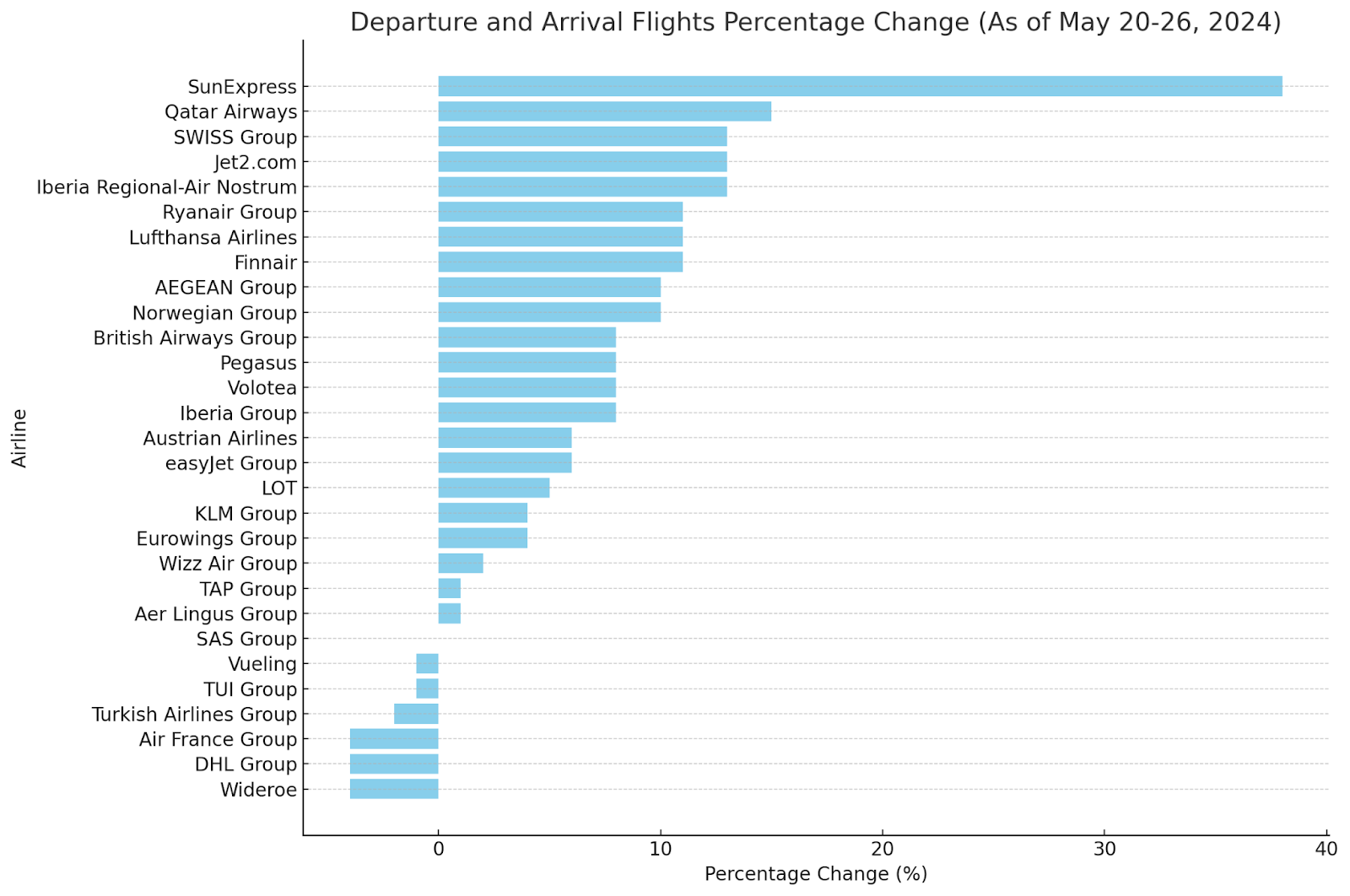

Despite its strong brand customer loyalty, TUI Fly Belgium remains in the bottom five for the most departure and arrival flights from 20 to 26 May 2024. Its small market share faces pressure from rivals like Ryanair and EasyJet’s aggressive pricing and expansion strategies.

Graph B shows the percentage change in airline departure and arrival flights as of 20–26 May 2024.

Route Network and Fleet Composition

Their route network primarily focuses on leisure destinations across Europe and Africa, with 180 available routes to more than 100 airports. Their modern and fuel-efficient aircraft fleet supports a wide range of short to medium-haul flights, catering to the holiday travel segment.

Pricing Strategy and Customer Segments

TUI Fly Belgium employs a value-based pricing strategy, targeting cost-conscious travellers seeking reliable service and convenience.

-

Dynamic pricing: For instance, ticket prices for popular holiday destinations like Tenerife or Mallorca might be higher during peak travel seasons (summer and winter) and lower during off-peak times (early spring or late autumn).

-

Ancillary revenue: Passengers can opt for premium services such as extra legroom seats or fast-track security clearance, adding convenience for a fee.

-

Promotional offers and discounts: To attract budget-conscious travellers, early-bird specials, last-minute deals, and holiday sales could be launched.

-

Bundled packages: A bundled package to a Mediterranean resort might include flights, hotel stays, and guided tours, offering a one-stop solution for holiday planning.

Strengths and Weaknesses

Strengths

-

Brand Recognition: Strong brand association with leisure travel and the TUI Group’s reputation.

-

Diverse Route Network: Extensive network covering popular holiday destinations.

-

Customer Loyalty: High Levels of repeat customers due to consistent service quality.

Weaknesses

-

Limited Market Share: Intense competition from larger LCCs affects market penetration.

-

Operational Costs: Higher operations costs compared to ultra-low-cost competitors.

External Opportunities and Threats

Opportunities

-

Market Expansion: Potential to explore underserved routes and expand into new markets.

-

Partnerships and Alliances: Opportunities to form strategic alliances with other carriers and travel companies.

-

Digital Innovations: Enhancing digital platforms to improve customer experience and operational efficiency.

Threats

-

Economic Volatility: Fluctuations in fuel prices and economic downturns impact travel demand.

-

Regulatory Changes: Increasing regulatory pressures and environmental compliance costs.

-

Intense Competition: Aggressive strategies by competitors lead to price wars and market share erosion.

Strategic Recommendations

Market Expansion and Network Optimisation

TUI Fly Belgium can strengthen its market presence by expanding its route network to include untapped destinations. Data analytics to identify emerging travel patterns can help boost expansion.

Enhancing Customer Experience

To maintain loyalty and attract new passengers, TUI Fly Belgium must prioritise customer service improvements such as personalised in-flight services, better digital booking, and smoother check-ins.

Improved customer experience also includes easier compensation claims processing to ease customer frustration during delays. To learn more about TUI fly Belgium’s current compensation structures, follow this link: https://www.skycop.com/compensation/tui-fly-belgium/.

Operational Improvements

Adopting advanced technologies and process optimisations can enhance operational efficiency. Implementing predictive maintenance for aircraft, optimising fuel management, and streamlining ground operations can lead to substantial cost savings.

Sustainability Initiatives

Sustainability is vital. To align with global trends, TUI Fly Belgium must invest in fuel-efficient planes, cut carbon emissions, and explore eco-friendly fuels.

These initiatives appeal to environmentally conscious travellers. To thrive in a competitive market, TUI Fly Belgium should expand and improve customer service.

Trending

-

1 SEO Mistakes That Could Be Costing Your Shopify Store Sales

Daniel Hall -

2 Strategies for Safeguarding Assets and Investments

Daniel Hall -

3 The Role of PR Firms in Crisis Management and Damage Control

Nitish Mathur -

4 The Competitive Landscape of Low-Cost Carriers in Belgium: TUI Fly Belgium’s Position

Daniel Hall -

5 How to Make Appealing Visuals for Your E-commerce Store

Daniel Hall

Comments